YEARS

of southEast Asian partnerships

Key Highlights

The Group achieved good overall results in 2018, with strong growth in revenue and underlying profit to shareholders. View Financial Highlights

View PDFCOMBINED GROSS REVENUE*

+7%

REVENUE

+10%

UNDERLYING PROFIT

+12%

PROFIT ATTRIBUTABLE TO SHAREHOLDERS

(55%)

SHAREHOLDERS’ FUNDS

(4%)

DIVIDEND PER SHARE

+1%

* Includes 100% of revenue from associates and joint ventures

† Restated 2017 figures

Chairman’s Statement

View PDF2019 marks 120 years of Southeast Asian partnerships for Jardine Cycle & Carriage. We have grown alongside the development of Southeast Asia with strategic, long-term interests that support the region’s urbanisation and emerging middle class. Southeast Asia is projected to be the fourth largest economy in the world by 2030 and the Group remains committed to investing in the continued growth of the region.

Read More

US$250mTotal investment from Astra into GOJEK

Combined gross revenue*

US$40bn

Revenue

US$19bn

Underlying profit

US$858m

Shareholders’ funds

US$6,148m

Dividend per share

US¢87

* Includes 100% of revenue from associates and joint ventures

Cycle & Carriage Singapore signed an agreement with BYD to distribute electric forklifts in Singapore

THACO continued investments in automotive and further diversified into agriculture

Strong contributions from REE Corpʼs power and water investments

OVERVIEW

The Group achieved good overall results in 2018, with strong growth in Astra and improved performance versus the prior year in its Direct Motor Interests and Other Strategic Interests.

PERFORMANCE

The Group’s revenue for the year increased by 10% to US$19 billion, due largely to revenue growth in most of Astra’s businesses. The Group’s underlying profit attributable to shareholders was 12% higher at US$858 million and underlying profit per share was also 12% higher at US¢217. Profit attributable to shareholders fell by 55% from US$939 million to US$420 million, after accounting for net non-trading losses of US$438 million, principally unrealised fair value losses related to non-current investments.

Astra contributed US$719 million to the Group’s underlying profit, an increase of 15%. The underlying profit from its Direct Motor Interests was 19% higher at US$145 million, while its Other Strategic Interests contributed an underlying profit of US$71 million, up from US$34 million in the previous year.

The Group’s financial position remains strong, with shareholders’ funds at US$6,148 million and net asset value per share at US$15.56 at the year end, albeit down by 4% from the end of 2017 due to translation losses resulting from the weaker Rupiah. The Group continues to invest, with capital expenditure and investments amounting to US$3.1 billion in 2018. Consolidated net debt, excluding financial services companies, was US$2.2 billion at 31st December 2018, representing gearing of 16%.

The Board is recommending a final one-tier tax dividend of US¢69 per share (2017: US¢68 per share) which, together with the interim dividend, will produce a total dividend for the year of US¢87 per share (2017: US¢86 per share).

STRATEGIC DEVELOPMENTS

The Group continues to pursue expansion in Southeast Asia by supporting the growth of Astra in Indonesia, strengthening its Direct Motor Interests and growing its Other Strategic Interests by investing in market-leading companies which provide exposure to new business sectors in the region.

ASTRA

Astra continues to seek opportunities in Indonesia to expand its existing activities and move into new sectors.

In 2018, Astra expanded its operations with further investments in toll roads, mining and property, as well as an interest in GOJEK, Indonesia’s leading multi-platform technology group.

Astra and WeLab, a leading technology enabler for consumer lending in mainland China and Hong Kong, announced the establishment of Astra WeLab Digital Arta to offer mobile lending products to retail consumers and provide financial technology solutions to enterprise customers. Astra Land Indonesia, a 50%-owned joint venture, purchased a 3-hectare site in Jakarta’s Central Business District for residential and commercial development. Astra, through its 59.5%-owned subsidiary, United Tractors, acquired a 95% interest in Agincourt Resources, which operates the Martabe gold mine in Sumatra.

DIRECT MOTOR INTERESTS

The Group’s Direct Motor Interests are focused on building customer-centric and innovative organisations across Singapore, Malaysia, Myanmar and Indonesia to strengthen their competitive positions.

Cycle & Carriage Singapore was appointed the exclusive distributor of electric forklifts manufactured by Chinese electric transport and technology company, BYD. A new wholly-owned subsidiary, Cycle & Carriage Leasing, was incorporated in January 2019 to provide vehicle leasing services.

Cycle & Carriage Singapore signed an agreement with BYD to distribute electric forklifts in Singapore

In November 2018, Daimler AG exercised its call option to buy Cycle & Carriage Bintang’s (“CCB”) 49% interest in Mercedes-Benz Malaysia for US$16 million, with the disposal to take place at the end of November 2019 after a 12-month notice period. CCB will continue to focus on its dealership operations.

In Vietnam, Truong Hai Auto Corporation continued to invest in its core automotive business, and in August 2018, it further diversified into the agriculture business.

THACO further diversified into property development and agriculture

OTHER STRATEGIC INTERESTS

The diversified businesses of the Group include Other Strategic Interests in Siam City Cement, Refrigeration Electrical Engineering Corporation (“REE Corp”) and Vinamilk. The Group gains exposure to key Southeast Asian economies by supporting the long-term growth of these market-leading companies.

Strong contributions from power and water investment under REE Corp

PEOPLE

Our success is attributable to our employees, business partners and shareholders. On behalf of the Board, I would like to thank our more than 250,000 employees across the region for their hard work and dedication, and our business partners and shareholders for their ongoing support.

Mr Chang See Hiang will be retiring as director of the Company at the close of the upcoming Annual General Meeting in April 2019, after more than 21 years on the Board. He has also served as Chairman of the Nominating Committee and as a member of both the Audit Committee and the Remuneration Committee for a number of years. On behalf of the Board, I would like to record our appreciation and thank Mr Chang for his valuable contribution to the Group.

I am delighted to welcome Mr Steven Phan who will join the Board in April 2019 as an independent director. Mr Phan is a chartered accountant with extensive knowledge and experience in auditing, advisory and consulting work.

Mr Adrian Teng is stepping down as Group Finance Director on 31st March 2019 to pursue other interests and opportunities outside the Company. On behalf of the Board, I would like to thank him for his valuable contribution to the Group. Mr Stephen Gore, who is currently the Chief Financial Officer of Jardine Pacific and Jardine Motors, will succeed Mr Teng on 1st April 2019 as Group Finance Director.

OUTLOOK

The Group achieved good overall results in 2018, but Astra is likely to face a number of macro-economic and commercial headwinds in 2019, while the Group’s Direct Motor Interests and Other Strategic Interests may also see slower growth.

Ben Keswick

Chairman

27th February 2019

GROUP MANAGING DIRECTOR’S REVIEW

View PDFThe Group’s underlying profit rose 12% in 2018, due mainly to increased contributions from Astra’s heavy equipment, mining, construction and energy, and financial services businesses, which more than offset lower contributions from its agribusiness and automotive businesses. The Group’s Direct Motor Interests and Other Strategic Interests also saw higher contributions than the previous year.

Read More

15%Increase in net profit for Astra

PERFORMANCE

The Group reported an underlying profit attributable to shareholders of US$858 million, 12% up on the previous year, while underlying profit per share also grew by 12% to US¢217. Profit attributable to shareholders was down 55% from US$939 million to US$420 million, after accounting for net non-trading losses of US$438 million, principally unrealised fair value losses related to non-current investments. These resulted from the adoption of a new accounting standard which requires the unrealised gains and losses arising from the revaluation of equity investments at the end of each financial period to be included in the profit and loss account.

The Group’s consolidated net debt, excluding Astra’s financial services subsidiaries, was US$2.2 billion at the end of 2018, representing gearing of 16%, compared to US$819 million at the end of 2017, when gearing was 6%. This increase was largely due to investments by Astra in its toll road businesses, a gold mining concession and GOJEK, together with the Group’s investment in Toyota Motor Corporation and further purchases in Vinamilk and in its associates and joint ventures. Net debt within Astra’s financial services subsidiaries was US$3.3 billion, compared with US$3.4 billion at the end of 2017. JC&C parent’s net debt was US$1.3 billion at the end of 2018, an increase from US$1.2 billion at the end of 2017.

Underlying Profit Attributable to Shareholders by Business

GROUP REVIEW

ASTRA

Astra reported a net profit equivalent to US$1.5 billion, under Indonesian accounting standards, 15% higher in its local currency terms.

Automotive

Net income from Astra’s automotive division was 4% lower at US$597 million, mainly due to lower operating margins despite higher automotive sales.

The wholesale market for cars was 7% higher in the year compared to 2017 at 1.2 million units. Astra’s car sales were 1% higher at 582,000 units, but increased competition resulted in a decline in market share from 54% to 51%. The group launched 18 new models and seven revamped models during the year.

The wholesale market for motorcycles increased by 8% to 6.4 million units. Astra Honda Motor’s domestic sales increased by 9% to 4.8 million units, with its market share stable at 75%. The group launched six new models and 19 revamped models during the year.

Astra Otoparts, the group’s automotive components business, reported net income 11% higher at US$43 million, with increased revenues from its original equipment manufacturing and replacement market segments.

Financial Services

Net income from the group’s financial services division increased by 28% to US$337 million. This resulted from improved contributions from its consumer finance, banking and general insurance businesses.

The net income contribution from the group’s car-focused finance companies increased by 26% to US$86 million, mainly due to lower loan loss provisions and an increased shareholding in Astra Sedaya Finance. The net income contribution from motorcycle-focused Federal International Finance was 16% higher at US$162 million, reflecting a larger loan portfolio. The group’s consumer finance businesses overall saw a 1% decrease in the amount financed to US$5.6 billion during the year, due to a reduction in the amount financed in the low-cost car segment.

The net income contribution from the group’s heavy equipment-focused finance operations increased by 30% to US$6 million, partly due to lower loss provisions. The amount financed decreased by 12% to US$363 million, mainly due to reduced lending to the small and medium-sized segment.

Permata Bank, in which Astra holds a 44.6% interest, reported net income of US$63 million, compared to US$56 million in 2017, mainly due to increased net interest income and recoveries from non-performing loans. The bank’s gross non-performing loan ratio was 4.4% at the end of 2018 compared to 4.6% at the end of 2017, while its net non-performing loan ratio was stable at 1.7%.

Asuransi Astra Buana, the group’s general insurance company, reported net income 4% higher at US$73 million, primarily due to higher investment income. During the year, the group’s life insurance joint venture, Astra Aviva Life, acquired more than 339,000 new individual life customers and more than 713,000 new participants for its corporate employee benefits programmes.

Heavy Equipment, Mining, Construction & Energy

Net income from Astra’s heavy equipment, mining, construction and energy division increased by 48% to US$465 million.

United Tractors, which is 59.5%-owned, reported net income of US$775 million, 50% higher than the previous year, mainly due to improved performances in its construction machinery, mining contracting and mining operations, all of which benefited from higher coal prices compared with 2017.

Within United Tractors’ construction machinery business, Komatsu heavy equipment sales rose 29% to 4,878 units, while parts and service revenues were also higher. The mining contracting operations of wholly-owned Pamapersada Nusantara recorded a 22% increase in overburden removal volume at 979 million bank cubic metres and 11% higher coal production at 125 million tonnes. United Tractors’ coal mining subsidiaries reported an 11% increase in coal sales to 7 million tonnes, including sales of 807,000 tonnes of coking coal by 80.1%-owned Suprabari Mapanindo Mineral, which became operational in late 2017.

Agincourt Resources, in which United Tractors acquired a 95% interest in December 2018 and which operates a gold mining concession in Sumatra, reported gold sales of 35,000 oz in December 2018.

Acset Indonusa, United Tractor’s 50.1%-owned general contractor, reported a 88% decrease in net income to US$1 million, mainly due to increased financing costs. US$112 million of new construction projects were secured during 2018.

25%-owned Bhumi Jati Power is in the process of constructing two 1,000MW power plants in Central Java, which are scheduled to start commercial operation in 2021.

Agribusiness

Net income from Astra’s agribusiness division was down 27% at US$80 million.

Astra Agro Lestari, which is 79.7%-owned, reported a 27% decline in net income to US$101 million, primarily due to a fall in crude palm oil prices, which were 12% lower at Rp7,275/kg compared with the average in 2017. This more than offset a 30% increase in crude palm oil and derivatives sales to 2.3 million tonnes.

Infrastructure & Logistics

The group’s infrastructure and logistics division reported a net income of US$14 million in 2018, compared to a net loss of US$17 million in the prior year. This was mainly due to improved earnings from the Tangerang-Merak toll road and Serasi Autoraya, as well as the inclusion in the prior year’s results of a one-off loss on the disposal of Astra’s 49% interest in PAM Lyonnaise Jaya. Astra has interests in 302km of operational toll roads along the Trans-Java network, with a further 11km in Greater Jakarta under construction.

Serasi Autoraya’s net income increased by 50% to US$21 million, primarily due to improved operating margins in its car leasing and rental businesses. Its vehicles under contract decreased by 2% to 23,000 units.

Information Technology

Net income from the group’s information technology division was 5% higher at US$15 million.

Astra Graphia, which is 76.9%-owned, reported net income of US$19 million, 5% higher than the previous year, as a result of increased revenue from its document and IT solution businesses.

Property

The group’s property division reported a 28% lower net profit at US$11 million, due mainly to reduced development earnings recognised from its Anandamaya Residences project as a result of lower percentage completion during the period in its final stages of construction. The group’s other property development projects comprise its interests in Arumaya in South Jakarta and Asya in East Jakarta, both residential projects, and a 3-hectare residential and commercial development in Jakarta’s Central Business District.

DIRECT MOTOR INTERESTS

The Group’s Direct Motor Interests contributed a profit of US$145 million, 19% higher than the prior year.

Singapore

The Singapore passenger car market fell by 13% to 80,300 units, following a decrease in the number of certificates of entitlement issued. The Group’s wholly-owned business, Cycle & Carriage Singapore, saw its earnings grow by 8% to US$62 million due to improved margins, despite a 7% decrease in passenger car sales to 13,300 units. The Group’s passenger car market share improved from 16% to 17%.

Malaysia

In Malaysia, 59.1%-owned Cycle & Carriage Bintang contributed a profit of US$2 million, mainly comprising dividend income from its investment in Mercedes-Benz Malaysia. At the trading level, a small profit was recorded, compared to a loss in the previous year, as the company benefited from operational improvements and the zero rate of Goods & Services Tax from June to August.

Myanmar

Cycle & Carriage Myanmar, in which the Group owns a 60% interest, contributed a loss of US$5 million, compared to the loss of US$3 million in the prior year, due mainly to higher depreciation charges on new facilities in Yangon and higher stock provisions, partly offset by higher unit sales.

Indonesia

In Indonesia, 46.2%-owned Tunas Ridean’s profit contribution of US$18 million was 17% higher than the prior year, reflecting improved performances across all its segments: automotive, rental operations and consumer finance. Motor car sales of 48,300 units were 6% down due to intense competition, while motorcycle sales, which mainly occur in Sumatra, rose by 11% to 248,900 units, benefiting from higher agricultural prices.

Vietnam

In Vietnam, 25.3%-owned Truong Hai Auto Corporation (“THACO”) performed well, with a 29% increase in its profit contribution to US$73 million, due mainly to higher unit sales and improved margins. The vehicle market grew by 9% to 362,000 units as tariffs on CBUs were eliminated, following the full implementation of the ASEAN Trade in Goods Agreement in 2018. THACO’s overall vehicle sales rose 11% to 97,100 units with market share stable at 27%.

OTHER STRATEGIC INTERESTS

The Group’s Other Strategic Interests contributed a profit of US$71 million, more than double the previous year, benefiting in particular from Vinamilk dividends and improved results from Siam City Cement Public Company (“SCCC”) and Refrigeration Electrical Engineering Corporation (“REE Corp”).

SCCC, which is 25.5%-owned, contributed a profit of US$20 million, compared to US$11 million in the previous year, due to improved domestic performance and lower one-off expenses, partially offset by lower contributions from its regional operations. The Group’s 24.9%-owned REE Corp, contributed US$19 million, 39% up on the previous year, due mainly to strong contributions from its power and water investments. The Group’s 10.6% interest in Vinamilk, which was acquired in the last quarter of 2017, produced dividend income of US$32 million, compared to US$9 million in 2017.

Alex Newbigging

Group Managing Director

27th February 2019

GROUP FINANCE DIRECTOR’S REVIEW

View PDFIn 2018, the Group’s revenue grew by 10% to US$19 billion, with growth in most of Astra’s businesses, principally heavy equipment, mining, construction and energy. Gross revenue, including 100% of revenue from associates and joint ventures, which is a measure of the full extent of the Group’s operations, increased by 7% to US$40.2 billion. The increase was largely due to the Group’s associates and joint ventures in Astra and Truong Hai Automotive (“THACO”).

Read MoreACCOUNTING POLICIES

With effect from 1st January 2018, Singapore Financial Reporting Standards (International) (“SFRS(I)”) and International Financial Reporting Standards (“IFRS”) have fully converged. The Company and Group accounts have been prepared under the dual compliance framework of both SFRS(I) and IFRS. The Directors continue to review the appropriateness of the accounting policies adopted by the Group, having regard to developments in SFRS(I) and IFRS. In 2018, the following new standards which became effective from 1st January 2018 were adopted: SFRS(I)/IFRS 9 Financial Instruments and SFRS(I)/IFRS 15 Revenue from Contracts with Customers. The comparative financial statements have been restated in accordance with the requirements under IFRS and SFRS(I). In addition, additional disclosures have been made in the financial statements in respect of revenue from contracts with customers and impairment of debtors.

RESULTS

In 2018, the Group’s revenue grew by 10% to US$19 billion, with growth in most of Astra’s businesses, principally heavy equipment, mining, construction and energy. Gross revenue, including 100% of revenue from associates and joint ventures, which is a measure of the full extent of the Group’s operations, increased by 7% to US$40.2 billion. The increase was largely due to the Group’s associates and joint ventures in Astra and Truong Hai Automotive (“THACO”).

Underlying operating profit from the Group’s parent company and subsidiaries of US$2,160 million was US$422 million or 24% higher than the previous year. Astra’s underlying operating profit increased by US$426 million or 26% to US$2,087 million, which was largely due to its heavy equipment, mining, construction and energy businesses which benefited from higher coal prices. The Group’s Direct Motor Interests saw a US$12 million or 17% increase in contribution due to improved margins in Cycle & Carriage Singapore, while Cycle & Carriage Bintang contributed a profit, compared with a loss in the prior year, as sales benefited from the zero rate of Goods & Services Tax (“GST”) from June to August in 2018. Dividends from Vinamilk increased by US$23 million as dividends for a full year were received. Corporate costs, excluding net financing charges, were US$39 million higher due to exchange losses arising from the translation of US dollar net borrowings.

Net financing charges, excluding those relating to the Group’s consumer finance and leasing activities, increased by US$114 million to US$161 million, mainly due to the higher levels of average net debt at the Group’s parent company and Astra parent company. Interest cover (calculated as the sum of underlying operating profit and share of results of associates and joint ventures divided by net financing charges) excluding the financial services companies decreased to 16 times (2017: 37 times) due to the increase in debt.

The Group’s share of underlying results of associates and joint ventures increased by US$82 million or 15% to US$615 million. Contributions from Astra’s associates and joint ventures increased by US$49 million with improvements in all businesses, principally those in financial services. The contribution from Direct Motor Interests associates and joint ventures increased by US$17 million with improved performance at THACO and Tunas Ridean arising from higher sales, partially offset by losses in the Group’s Myanmar joint venture. In Other Strategic Interests, contributions from Siam City Cement (“SCCC”) and Refrigeration Electrical Engineering Corporation (“REE Corp”) increased by US$16 million with SCCC benefiting from an improved domestic performance and lower one-off expenses while REE Corp’s strong performance resulted from its power and water investments.

The underlying effective tax rate of the Group in 2018, excluding associates and joint ventures, was 30%. This compared with 29% in 2017.

The Group’s underlying profit attributable to shareholders for the year was 12% up at US$858 million.

Consolidated Profit and Loss Account

NON-TRADING ITEMS

In 2018, the Group had net non-trading losses of US$435 million, principally due to unrealised fair value losses related to non-current investments. These resulted from the adoption of IFRS 9 Financial Instruments which require the unrealised gains and losses arising from the revaluation of equity investments at the end of each financial period to be included in the profit and loss account. In 2017, the Group had a net non-trading gain of US$172 million largely due to the unrealised fair value gains related to non-current investments.

DIVIDENDS

The Board is recommending a final one-tier tax-exempt dividend of US¢69 per share (2017: US¢68 per share), which together with the interim dividend will give a total dividend of US¢87 per share for the year (2017: US¢86 per share). Shareholders will have the option to receive the dividend in Singapore dollars and in the absence of any election, the dividend will be paid in US dollars.

CASH FLOW

Cash inflow from the Group’s operating activities was US$1,995 million, US$340 million higher than the previous year, mainly due to higher inflows from Astra’s financial services and heavy equipment, mining, construction and energy businesses.

The net cash outflow from investing activities was US$2,284 million, slightly lower than the previous year. Capital expenditure and investments before disposals for the year amounted to US$3,105 million (2017: US$3,351 million) which mainly comprised:

- US$72 million for the purchase of intangible assets, which included US$43 million for the acquisition costs of contracts in Astra’s general insurance business;

- US$937 million of property, plant and equipment mainly by Astra comprising US$722 million of heavy equipment and machinery for its heavy equipment and mining, construction and energy businesses, US$110 million of equipment and network development for its automotive businesses and US$65 million for its agribusiness;

- US$27 million for additions to investment properties in Astra and US$45 million for additions to bearer plants in Astra;

- US$1.2 billion mainly for Astra’s acquisition of a 95%interest in Agincourt Resources, which operates the Martabe gold mine in Sumatra;

- US$134 million for acquisitions and capital injection into various associates and joint ventures and investments in toll roads;

- US$692 million for investments, increasing its interest in Vinamilk and taking interests in GOJEK and Toyota Motor Corporation together with investments by Astra’s general insurance business.

The contribution to the Group’s cashflow from disposals for the year amounted to US$264 million which arose mainly from the sale of other investments by Astra’s general insurance business.

Cash outflow from financing activities was US$349 million, compared to a cash inflow of US$823 million in the previous year, mainly due to a lower net drawdown of borrowings and higher dividends paid.

TREASURY POLICY

The Group manages its exposure to financial risk using a variety of techniques and instruments. The main objectives are to limit foreign exchange and interest rate risks and to provide a degree of certainty about costs. The investment of the Group’s surplus cash resources is managed so as to minimise risk while seeking to enhance yield. Appropriate credit guidelines are in place to manage counterparty risk.

When economically sensible to do so, borrowings are taken in local currency to hedge foreign exchange exposures on investments. A portion of borrowings is denominated in fixed rates. Adequate headroom in committed facilities is maintained to facilitate the Group’s capacity to pursue new investment opportunities and to provide some protection against market uncertainties. Overall, the Group’s funding arrangements are designed to keep an appropriate balance between equity and debt from banks and capital markets, both short and long term, to give flexibility to develop the business.

The Group’s treasury operations are managed as cost centres and are not permitted to undertake speculative transactions unrelated to underlying financial exposures.

The Group’s financial risk factors are set out on page 87 to 93.

FUNDING

The Group is well financed with strong liquidity. The Group’s consolidated net debt, excluding borrowings within Astra’s financial services subsidiaries, was US$2.2 billion at the end of 2018, representing gearing of 16%, compared to net debt of US$819 million at the end of 2017, when gearing was 6%. The Group parent company’s net debt was US$1.3 billion compared to net debt of US$1.2 million at the end of 2017. Net debt within Astra’s financial services operations decreased slightly to US$3.3 billion at the end of 2018.

At the year-end, the Group had undrawn committed facilities of some US$3.8 billion. In addition, the Group had available liquid funds of US$1.9 billion.

80% of the Group’s borrowings were non-US dollar denominated and directly related to the Group’s businesses in the countries of the currencies concerned.

At the year-end, approximately 71% of the Group’s borrowings, exclusive of Astra’ financial services companies, were at floating rates and the remaining 29% were at fixed rates including those hedges with derivative instruments with major creditworthy financial institutions. For Astra’s financial services companies, 93% of their borrowings were at fixed rates.

BALANCE SHEET

Shareholders’ funds of US$6.1 billion at the end of 2018 were 4% lower than 2017 due to translation losses arising from the weaker Rupiah. Intangible assets increased by US$551 million to US$1.6 billion, due mainly to an increase in mining exploration costs arising from the consolidation of a new subsidiary, Agincourt Resources. Property, plant and equipment increased by US$1.1 billion to US$4.5 billion, largely due to the purchase of heavy equipment and machinery. Non-current investments decreased by US$62 million to US$1.9 billion mainly due to fair value losses arising from the revaluation of equity investments. Trade debtors increased mainly due to higher receivables from the heavy equipment business. Stocks increased by US$316 million to US$2.0 billion due to purchases of heavy equipment and higher inventory days for other stocks. The increase in trade creditors was mainly due to higher purchases of heavy equipment stocks.

RISK MANAGEMENT REVIEW

A review of the major risks facing the Group is set out on page 44 to 45.

Adrian Teng

Group Finance Director

27th February 2019

Group at a Glance

A long-term shareholder of strategic interests in Southeast Asia, JC&C is a leading Singapore-listed company and a member of the Jardine Matheson Group. JC&C has a majority interest in Astra, an established regional automotive presence through its Direct Motor Interests, as well as diversified Other Strategic Interests in key Southeast Asian economies.

View PDF

ASTRA

JC&C has 50.1% interest in Astra. Astra is a diversified business group with seven core businesses in Indonesia. It is listed on the Indonesia Stock Exchange.

Read More

DIRECT MOTOR INTERESTS

JC&C has an established regional automotive presence through Direct Motor Interests operating in Singapore, Malaysia and Myanmar under the Cycle & Carriage banner, as well as through Tunas Ridean in Indonesia and Truong Hai Auto Corporation in Vietnam.

Read More

OTHER STRATEGIC INTERESTS

Further diversifying JC&C’s businesses are Other Strategic Interests in Siam City Cement, Refrigeration Electrical Engineering Corporation and Vinamilk, market leaders through which JC&C gains exposure to key Southeast Asian economies by supporting the long-term growth of these companies.

Read More

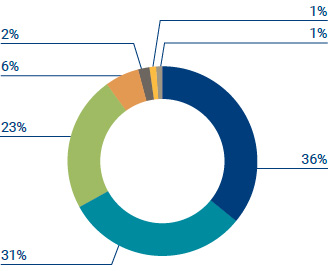

CONTRIBUTION BY ASTRA

US$718.7m*

+15% from US$622.3m in 2017

- Automotive

- Heavy Equipment, Mining, Construction & Energy

- Financial Services

- Agribusiness

- Property

- Infrastructure & Logistics

- Information Technology

Automotive

Astra is the largest independent automotive group in Southeast Asia. Its automotive business comprises the production, distribution, retail and aftersales service of motor vehicles and motorcycles. It is the sole distributor of Toyota, Daihatsu, Isuzu and Peugeot motor vehicles, a dealer of BMW motor vehicles and UD Trucks and a distributor of Honda motorcycles. Astra also manufactures and distributes automotive components.

Financial Services

Astra’s financial services are extensive, consisting of consumer financing for motor vehicles and motorcycles, heavy equipment financing and banking, as well as general and life insurance.

Heavy Equipment, Mining, Construction & Energy

Astra supplies construction and mining equipment, as well as provides aftersales service. It is the sole distributor of Komatsu heavy equipment and is the largest coal mining services contractor in Indonesia. It also participates in general construction and thermal power businesses.

Agribusiness

Astra’s agribusiness includes the cultivation, harvesting and processing of palm oil. It is a major producer of crude palm oil in Indonesia.

Infrastructure & Logistics

Astra’s infrastructure and logistics businesses include toll road development and management, with a total interest in 353km of toll roads in Indonesia.

Information Technology

Astra’s information technology business provides document information and communication technology solutions. It is the sole distributor of Fuji Xerox office equipment in Indonesia.

Property

Astra’s property business includes the Grade A office building, Menara Astra, the 509-unit Anandamaya Residences and two residential development projects, namely Arumaya in South Jakarta and Asya in East Jakarta, as well as a 3-hectare residential and commercial development in Jakarta’s Central Business District.

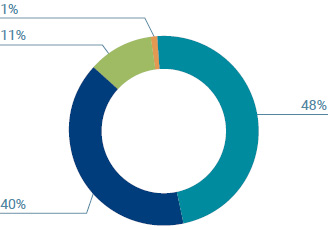

CONTRIBUTION BY DIRECT MOTOR INTERESTS

US$144.6m

+19% from US$121.3m in 2017

- Vietnam (Truong Hai Auto Corporation)

- Singapore

- Indonesia (Tunas Ridean)

- Malaysia

- Myanmar (not meaningful)

Singapore

Cycle & Carriage Singapore (100%) is a leading automotive group in Singapore. It is engaged in the distribution, retail and aftersales service of Mercedes-Benz, Mitsubishi, Kia, Citroën, DS Automobiles and Maxus motor vehicles, and retails used cars under its Republic Auto brand. It is also the exclusive distributor of BYD electric forklifts in Singapore.

Malaysia

Cycle & Carriage Bintang (59.1%) is listed on Bursa Malaysia. With an extensive network of 13 outlets across the country, Cycle & Carriage Bintang is a leading Mercedes-Benz dealer group in Malaysia, providing sales and aftersales services for Mercedes-Benz passenger cars and commercial vehicles, including FUSO trucks.

Myanmar

Cycle & Carriage Myanmar (60%) distributes, retails and provides aftersales services for Mercedes-Benz and Mazda passenger cars and commercial vehicles, as well as for FUSO commercial vehicles in Myanmar.

Indonesia

Tunas Ridean (46.2%) is listed on the Indonesia Stock Exchange and is a leading automotive dealer group in Indonesia. It represents Toyota, Daihatsu, BMW and Isuzu motor vehicles, as well as Honda motorcycles. Tunas Ridean also offers automotive rental and fleet management services. Additionally, it provides vehicle financing through its associate, Mandiri Tunas Finance.

Vietnam

Truong Hai Auto Corporation (“THACO”) (25.3%) is the largest automotive company in Vietnam. It manufactures, assembles, distributes, retails and provides aftersales service of commercial and passenger vehicles, representing BMW, MINI, Kia, Mazda, Peugeot, Foton and FUSO. THACO also engages in logistics, property development and agriculture in Vietnam.

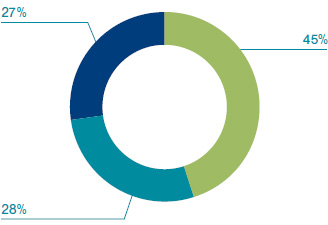

CONTRIBUTION BY OTHER STRATEGIC INTERESTS

US$71.1m

+107% from US$34.3m in 2017

- Vinamilk

- Siam City Cement

- Refrigeration Electrical Engineering Corporation

Siam City Cement

Siam City Cement (25.5%) is listed on the Stock Exchange of Thailand and is the second largest cement manufacturer in Thailand. Operating across South and Southeast Asia, it also produces concrete and other building materials.

Refrigeration Electrical Engineering Corporation

Refrigeration Electrical Engineering Corporation (24.9%) is listed on the Ho Chi Minh Stock Exchange. It is a diversified business group in Vietnam with operations in mechanical and electrical engineering services, real estate and power and water utility infrastructure.

Vinamilk

JC&C holds a 10.6% interest in Vietnam Dairy Products Joint Stock Company, known as Vinamilk. Vinamilk is listed on the Ho Chi Minh Stock Exchange and is the leading dairy producer in Vietnam.

What sets us apart

JC&C‘s diversified businesses and geographical reach have enabled us to gain experience and know-how across different markets. Here are five of our strengths that continue to support our growth.

View PDFLong-Term Partnerships

We have a 120-year track record of partnering leading businesses in sectors that support the economic development of Southeast Asia. This experience has helped us develop the in-depth knowledge, insight and relationships needed to drive sustainable growth in this exciting region.

Southeast Asia’s Market leaders

We are a firm believer in and strategic investor of market-leading businesses that bring significant economic and social benefits where they operate. These companies are well-established and are key drivers for the growth of their countries.

Diverse Interests

We harness strength through diverse business interests. We recognise the inherent nature of business cycles and the risks involved in operating in a single country and within a single industry. We manage our risks and build resilience by diversifying our businesses and markets.

Putting Our People First

Our people are central to our success. Our businesses have created over 250,000 jobs in Southeast Asia. We believe in respecting and treating our people well, and providing them opportunities to pursue lasting rewarding careers with us.

The Jardines Network

Being a member of the Jardine Matheson Group has further enhanced our abilities and competencies to support our businesses in Southeast Asia. This includes extending access through established networks and knowledge exchange about the dynamic operating and evolving regulatory environment.

Creating Value

At JC&C, we are committed to conducting business with the highest level of integrity and delivering long-term value to our shareholders, employees and communities. Our focus is on ensuring our financial performance remains robust and in line with our dedication to create value for our stakeholders.

View PDF120 Years of supporting the growth of Southeast Asia

2019 marks our 120th anniversary. Over the years, we have grown into a leading group with diversified interests in Southeast Asian companies and a combined gross revenue* of US$40 billion in 2018. We have strategically invested behind Southeast Asia’s growth through long-term interests that are fundamental to urbanisation such as infrastructure, cement, power production, and real estate. The Group’s consumer-focused interests such as automotive, financial services and dairy products further cater to the emerging ASEAN middle class segment.

* Includes 100% of revenue from associates and joint ventures

Most Transparent Company (runner-up) at the SIAS Investors’ Choice Awards 2018

Listed 50 years ago in 1969, JC&C is widely recognised as a top-performing blue-chip stock. In the past decade, JC&C generated annualised total returns of 18%, clinching the third highest spot among the 30 Straits Times Index constituent stocks. The strong performance attests to our long-term strategy that is rooted in the fundamentals of the industries that we invest in and never purely based on short-term metrics alone.

250,000 people across Southeast Asia

Together with our subsidiaries and associates, JC&C employs over 250,000 people across Southeast Asia. We invest in building enriching careers for our people by creating an environment where they can thrive and collaborate. We engage our people by listening to their views. Our internal communications platform, Workplace by Facebook, has connected our 2,000-strong workforce in Singapore, Malaysia and Myanmar on a single platform.

Champion of Good by the National Volunteer & Philanthropy Centre

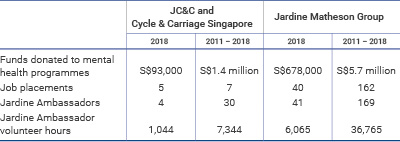

Jointly with the Jardine Matheson Group, JC&C supports Singapore’s mental health community by contributing to MINDSET, a registered charity. Efforts are focused on destigmatising mental health and helping people with mental health issues reintegrate with society. Our people also do their part as Jardine Ambassadors, volunteering over 7,300 hours for MINDSET since 2011. The Groupwide joint efforts towards mental health saw the Jardine Matheson Group named a “Champion of Good” in 2018.

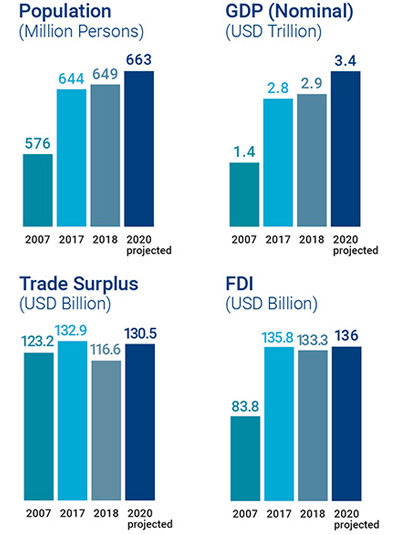

SOUTHEAST ASIA OUTLOOK

- 10 countries

- 3rd largest labour force in the world

- 649 million people

- 4th largest economy by 20301

1. Projected

View PDF

2. Economist Intelligence Unit

WHY DOES SOUTHEAST ASIA PRESENT SO MUCH OPPORTUNITY?

JC&C with its 120 years of experience in Southeast Asia has gained insights and deep connections in the region. Southeast Asia is one of the world’s fastest growing markets and a major manufacturing and trade hub. Despite their geographic proximity, the countries in this region vary beyond just culture and religion. Hence it is crucial for businesses to understand the complexities and differences that exist.

THE REGION IS AN ECONOMIC POWERHOUSE

If Southeast Asia were a single country, it would be the fifth-largest economy in the world, with a combined GDP of US$2.9 trillion in 2018. Some countries such as Vietnam, Indonesia and Malaysia, are projected to be the top ten fastest growing economies globally from 2016 to 2050. Southeast Asia is also in a strong fiscal position with government debt of under 50% of GDP. Countries’ savings levels have also remained steady since 2005, at about a third of GDP3.

JC&C's diversified interests in Southeast Asia support our risk-reward balance between growth countries, such as Indonesia and Vietnam with the more nascent Myanmar and the developed Singapore.

3. McKinsey Global Institute Analysis, “Understanding ASEAN: seven things you need to know”, May 2014

WELL-POSITIONED IN GLOBAL TRADE FLOWS

- 4th largest exporting region in the world, accounting for almost 10% of global exports.

- By 2025, over half of the world’s consuming class will live within a five-hour flight of Myanmar.

The region sits at the crossroads of many global flows and is a manufacturing and trading hub. It is strategically located to the south of China, east of India, north of Australia and west of the Pacific. ASEAN free-trade agreements with partners outside the region, including Australia, China, India, Japan, New Zealand and South Korea have been forged. In addition, intraregional trade within Southeast Asia presents growth opportunities for the region.

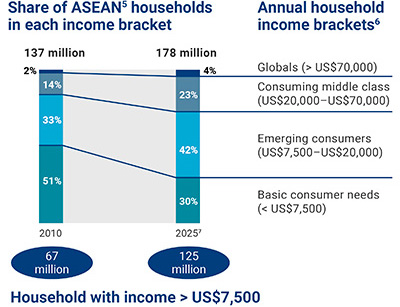

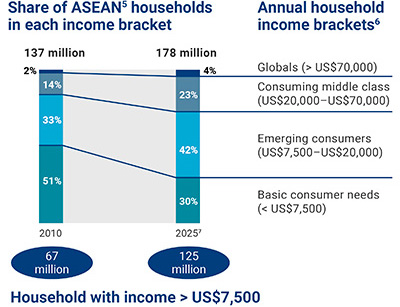

A GROWING HUB OF CONSUMER DEMAND

The region offers great growth potential for consumer-focused businesses. Income growth has remained strong since 2000, with average annual real gains of more than 5%. Some Southeast Asian countries have grown exponentially. From 2000 to 2017, Vietnam grew its per capita GDP by six times from US$390 to US$2,340, while Indonesia grew its per capita GDP by five times from US$780 to US$3,850. Singapore transformed from a third-world developing country into a developed modern economy in 50 years. It now has one of the highest GDP per capita in the world of US$57,700 in 20174.

Rapid urbanisation, industrialisation and modernisation are boosting the ‘consuming class’, with incomes exceeding the level at which they can begin to make significant discretionary purchases. This is expected to grow to 125 million households in Southeast Asia by 2025.

4. World Bank, GDP Per Capita, 2017

4. World Bank, GDP Per Capita, 2017

5. Association of Southeast Asian Nations; excluding Brunei

6. PPP 2005. Purchasing power parity adjusts for price differences in identical goods across countries to reflect differences in purchasing power in each country

7. Forecast; figures may not sum up because of rounding

5. Association of Southeast Asian Nations; excluding Brunei

6. PPP 2005. Purchasing power parity adjusts for price differences in identical goods across countries to reflect differences in purchasing power in each country

7. Forecast; figures may not sum up because of rounding

RAPIDLY GROWING DIGITAL NATIVES

Southeast Asia is the world’s fastest growing internet region with four million new users coming online every month for the next five years. This translates to a user base of 480 million by 2020. Today, Southeast Asian countries make up the world’s second largest community of Facebook users, behind only the United States. There are also over 700 million active mobile connections in Southeast Asia.

The young population and burgeoning middle class are driving the growth of the digital economy. It is projected that consumer online spending could rise to US$200 billion by 20255. This will create new businesses that disrupt inefficiencies and in turn, potentially open up opportunities for businesses to reach masses of consumers who were previously not targeted.

At JC&C, we recognise the shifts in business models with the rise of digital disruptions. To keep pace, we set up a digital team in 2017 to drive digital transformation within our core business as well as explore new growth opportunities.

8. The Business Times, “Asean’s digital economy key to unlocking growth”, 20th February 2018

EVOLVING CONSUMER ASPIRATIONS

Governments in the region have been investing in infrastructure, education and healthcare. These efforts generate a significant consumer base, increase consumption levels and grow the middle class, which drive demand and spending.

The rising middle class is set to elevate consumer aspirations and encourage more upmarket purchases. New car sales growth in Indonesia is an example of such growing aspirations, where sales grew 39% from 770,000 units in 2010 to 1.2 million units in 20186. In Vietnam, dairy consumption per capita doubled from 2010 to 2017, presently at 19kg per capita level.

JC&C’s investments in sectors that support urbanisation will continue to ride the growth of the middle class, upward social mobility and aspiring consumer preferences.

9. Gaikindo, Indonesian Automobile Industry Data

Sustainability

- In 2018, JC&C was ranked #57 in the Singapore Governance and Transparency Index published by the National University of Singapore. This is up from #88 in 2017 and #187 in 2016.

- JC&C was the runner-up for the ‘Most Transparent Company’ at the SIAS Investors’ Choice Awards 2018.

GOVERNANCE

JC&C is committed to high standards of accountability to achieve successful operations, reputable business practices and proper risk management.

JC&C adheres strictly to the principles and guidelines of the Singapore Code of Corporate Governance (“CCG”) 2012. JC&C also has a Corporate Governance Policies Manual to assist us to comply with the principles of the CCG. To ensure that all employees remain compliant in business dealings and standards, JC&C adheres to the Jardine Matheson Code of Conduct. This also applies to anti-corruption and compliance practices. In 2018, no cases of non-compliance with laws and regulations were identified for JC&C.

ENVIRONMENT

As an investment holding company, JC&C’s operations are based around our office, with most of our shared services sourced and managed jointly through our 100%-owned Cycle & Carriage Singapore.

Cycle & Carriage Singapore’s primary activities involve the distributing, retailing and servicing of motor vehicles. It takes active steps to track its environmental performance by monitoring its energy and water consumption as well as the waste disposal methods at its operations. In 2018, Cycle & Carriage Singapore entered into the material-handling equipment sector as the exclusive distributor of BYD electric forklifts. The BYD electric forklifts are designed for operational efficiency, generating cost savings with zero emission and pollution.

SOCIAL

Our people are integral to our businesses. We seek to provide a conducive and collaborative work environment where they feel engaged and their views heard.

- Impressive 11.8 years average length of stay for our Singapore-based employees.

- Highly-engaged workforce with 2,000 of our Singapore, Malaysia and Myanmar employees connected on our internal communications platform, Workplace by Facebook.

JC&C also supports the communities that we engage in. In Singapore, JC&C’s community initiatives are primarily focused on mental health, an area that is under-served and lacks support from the private sector. JC&C and 100%-owned subsidiary Cycle & Carriage Singapore jointly adopt MINDSET Care Limited (“MINDSET”), the registered charity of the Jardine Matheson Group (“Jardines”), to make a difference in mental health.

JC&C is committed to providing strategic expertise and resources to contribute positively to the mental health community. JC&C Group Managing Director, Alex Newbigging, serves as the Chairman of the Board and Steering Committee of MINDSET, while JC&C Group General Counsel, Jeffery Tan, is also MINDSET’s Chief Executive Officer and Company Secretary. In addition, JC&C provides and funds communications, corporate secretariat, finance and legal support to MINDSET.

Our employee volunteers also serve as Jardine Ambassadors for two-year stints to drive and execute MINDSET initiatives. Since 2011, there have been 30 Jardine Ambassadors from JC&C and Cycle & Carriage Singapore. They committed over 7,300 hours of volunteerism towards mental health.

Find out more about MINDSET programmes and efforts in its Annual Report 2018.

MINDSET Awards and Accolades

- Won ‘Charity Governance Award’ in the Small Charities category, conferred by Singapore’s Charity Council.

- Won ‘Charity Transparency Award’ for three consecutive years, conferred by Singapore’s Charity Council.

- Jardines named “Champion of Good” by the National Volunteer & Philanthropy Centre for efforts in leading the way in corporate giving.

Our employee volunteers also serve as Jardine Ambassadors for two-year stints to drive and execute MINDSET initiatives. Since 2011, there have been 30 Jardine Ambassadors from JC&C and Cycle & Carriage Singapore. They committed over 7,300 hours of volunteerism towards mental health.

Find out more about MINDSET programmes and efforts in its Annual Report 2018.

MINDSET Awards and Accolades

- Won ‘Charity Governance Award’ in the Small Charities category, conferred by Singapore’s Charity Council.

- Won ‘Charity Transparency Award’ for three consecutive years, conferred by Singapore’s Charity Council.

- Jardines named “Champion of Good” by the National Volunteer & Philanthropy Centre for efforts in leading the way in corporate giving.

MINDSET HIGHLIGHTS

112 persons-in-recovery trained by MINDSET Learning Hub to support social reintegration through employment

MINDSET Learning Hub was launched to support the social reintegration of mental health persons-in-recovery (“PIRs”) through employment. The hub provides PIRs with Workforce Skills Qualifications (“WSQ”) and non-WSQ job trainings, as well as job placement opportunities. In 2018, MINDSET Learning Hub trained 112 PIRs and provided 61 job placements. Since opening in October 2016, over 300 PIRs have been trained and 170 job placements provided. The hub was launched with a S$2 million commitment from Jardines. MINDSET Learning Hub is a collaboration with the Singapore Association for Mental Health.

In 2018, MINDSET provided 40 job placement opportunities for PIRs within Jardines in Singapore. Mental wellness workshops were also organised to facilitate PIRs’ assimilation into their new jobs. Since 2011, 162 PIRs were placed in roles within Jardine companies in Singapore.

MINDSET HIGHLIGHTS

S$397,000 raised through The MINDSET Challenge & Carnival

The MINDSET Challenge & Carnival raised over S$397,000 for the MINDSET Learning Hub in 2018. The event consisted of a 33-floor vertical race up Marina Bay Financial Centre, Tower 1, and a carnival for PIRs, Jardine employees, family and friends to raise awareness of mental health. In 2018, 30 PIRs participated in the vertical race for the first time by climbing five flights of stairs to drive the message of social inclusivity for persons with mental health issues.

MINDSET HIGHLIGHTS

Art exhibition featuring paintings by PIRs

To raise awareness and destigmatise mental health, MINDSET introduced “Colours of MINDSET”, a public art exhibition featuring paintings by PIRs in 2018. A total of 150 paintings were submitted for the competition.

MINDSET HIGHLIGHTS

MINDSET candies for the public, partners and corporate events

MINDSET partnered Mandarin Oriental, Singapore to produce MINDSET-branded candies as wedding favours. The proceeds from the MINDSET candies are channelled towards supporting the PIRs involved in the project. In support of this initiative, JC&C purchased over 100 bottles of the MINDSET candies for corporate events and partners in 2018.