Performance

The Company and Group accounts have been prepared under the dual compliance framework of both Singapore Financial Reporting Standards (International) (“SFRS(I)s”) and International Financial Reporting Standards (“IFRSs”), including International Accounting Standards (“IAS”) and Interpretations as issued by the International Accounting Standards Boards (“IASB”), collectively referred to as “IFRSs”. The Directors continue to review the appropriateness of the accounting policies adopted by the Group, having regard to developments in IFRSs. From 1st January 2024, the Group has adopted the new or amended IFRSs that are mandatory for application for the financial year. Changes to the Group’s accounting policies have been made as required, in accordance with the transitional provisions in the respective IFRSs. The adoption of these new or amended IFRSs did not result in substantial changes to the Group’s accounting policies and had no material effect on the amounts reported for the current or prior financial years.

In 2024, the Group’s revenue remains relatively flat at US$22 billion, mainly due to the translation impact from a weaker Indonesia Rupiah affecting Astra’s revenue reported in US dollar. In rupiah terms, most of Astra’s businesses saw increases in revenue. Cycle & Carriage reported higher revenue attributed to higher new and used car sales from its Singapore operations.

Underlying operating profit from the Group’s parent company and subsidiaries of US$2,787 million was 10% lower than the previous year. Astra’s underlying operating profit decreased by 9% to US$2,724 million compared to the previous year, mainly due to decreased earnings in its automotive and mining businesses. Cycle & Carriage reported a higher underlying operating profit mainly from its Singapore operations. Corporate costs were higher, mainly due to foreign exchange losses arising from the translation of foreign currency loans. Excluding this effect, corporate operating expenses remained stable.

Net financing charges, excluding those relating to the Group’s consumer finance and leasing activities, increased to US$142 million, mainly due to higher charges incurred by Astra’s heavy equipment business. This was partially offset by lower net financing charges at the Group’s parent company, due to lower net debt. The Group interest cover* excluding the financial services companies decreased to 21 times (2023: 27 times) because of the higher overall net financing charges.

The Group’s share of associates’ and joint ventures’ underlying results increased by 3% to US$751 million. Contributions from Astra’s associates and joint ventures increased by 4% mainly due to improved performances by its motorcycle businesses. THACO reported a 10% increase, mainly from the automotive business. The contribution from Tunas Ridean decreased by 9% mainly due to lower profits from its automotive business. The contribution from REE was 6% lower due to less favourable hydrology and lower hydropower demand, which impacted the contribution from its power generation business.

* calculated as underlying operating profit before the deduction of amortisation/depreciation of right-of-use assets, net of actual lease payments, and share of results of associates and joint ventures divided by net financing charges excluding interest on lease liabilities

The underlying effective tax rate of the Group in 2024, excluding associates and joint ventures, was 25%.

The Group’s underlying profit attributable to shareholders for the year was 5% lower at US$1,102 million.

In 2024, the Group had a net non-trading loss of US$156 million compared to a gain of US$55 million in 2023. The non-trading items recorded in the year mainly comprised a US$127 million loss from the disposal of SCCC, and unrealised fair value losses of US$28 million related to non-current investments. The non-trading items in 2023 included a US$81 million gain from the sale and leaseback of properties under Cycle & Carriage Singapore, offset by unrealised fair value losses of US$20 million related to non-current investments.

The Board is recommending a final one-tier tax exempt dividend of US¢84 per share (2023: US¢90 per share), which together with the interim dividend will produce total dividend for the year of US¢112 per share (2023: US¢118 per share).

The final dividend will be payable on 13th June 2025, subject to approval at the Annual General Meeting to be held on 30th April 2025, to those persons registered as shareholders, on 30th May 2025. Dividends are usually declared on a semi-annual basis for every six-month period ending 30th June (in respect of an interim dividend) and 31st December (in respect of a final dividend).

Cash inflow from the Group’s operating activities was US$3.0 billion, US$0.6 billion higher than the previous year, mainly due to improved working capital management and higher dividends received from associates and joint ventures.

Cash outflow from investing activities before disposals amounted to US$1.7 billion, and this included the following:

The contribution to the Group’s cash flow from disposals for the year amounted to US$0.6 billion, which arose mainly from the disposal of JC&C’s 25.5% interest in SCCC and the sale of investments by Astra’s insurance business.

Summarised Cash Flow

The Group manages its exposure to financial risks using a variety of techniques and instruments. The main objectives are to limit foreign exchange and interest rate risks to provide a degree of certainty about costs. The investment of the Group’s cash resources is managed so as to minimise risk, while seeking to enhance yield. Appropriate credit guidelines are in place to manage counterparty risk.

When economically sensible to do so, borrowings are taken in local currency to minimise foreign exchange exposures on investments. A portion of borrowings is denominated in fixed rates. Adequate headroom in committed facilities is maintained to facilitate the Group’s capacity to pursue new investment opportunities and to provide some protection against market uncertainties. Overall, the Group’s funding arrangements are designed to keep an appropriate balance between equity and debt from banks and capital markets, both short- and long-term in tenure, to give flexibility to develop the business.

The Group’s treasury operations are managed as cost centres and are not permitted to undertake speculative transactions unrelated to underlying financial exposures.

The Group’s financial risk factors are set out on pages 97 to 102.

The Group’s consolidated net debt position, excluding the net borrowings within Astra’s financial services subsidiaries, was US$235 million at the end of 2024, compared to US$1.1 billion at the end of 2023. This decrease was mainly due to JC&C’s lower corporate net debt of US$816 million, compared to US$1.3 billion at the end of 2023 as well as Astra’s improved operating cash flow. Net debt within Astra’s financial services subsidiaries increased from US$3.4 billion to US$3.7 billion.

At the year-end, the Group had undrawn committed facilities of some US$2.8 billion. In addition, the Group had available liquid funds of US$3.1 billion. 85% of the Group’s borrowings were non-US dollar denominated and directly related to the Group’s businesses in the countries of the currencies concerned. At the year-end, approximately 60% of the Group’s borrowings, excluding Astra’s financial services companies, were at floating rates and the remaining 40% were at fixed rates including those hedged with derivative instruments with major creditworthy financial institutions. For Astra’s financial services companies, 87% of their borrowings were at fixed rates.

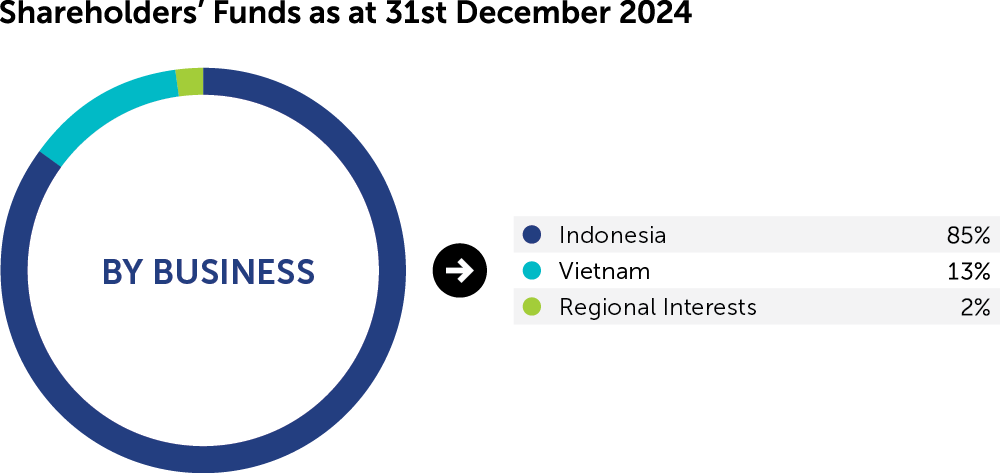

Shareholders’ funds as at 31st December 2024 were analysed by business. There were no significant changes from the prior year.

A review of the major risks facing the Group is set out on pages 45 to 50.

Amy Hsu

Group Finance Director