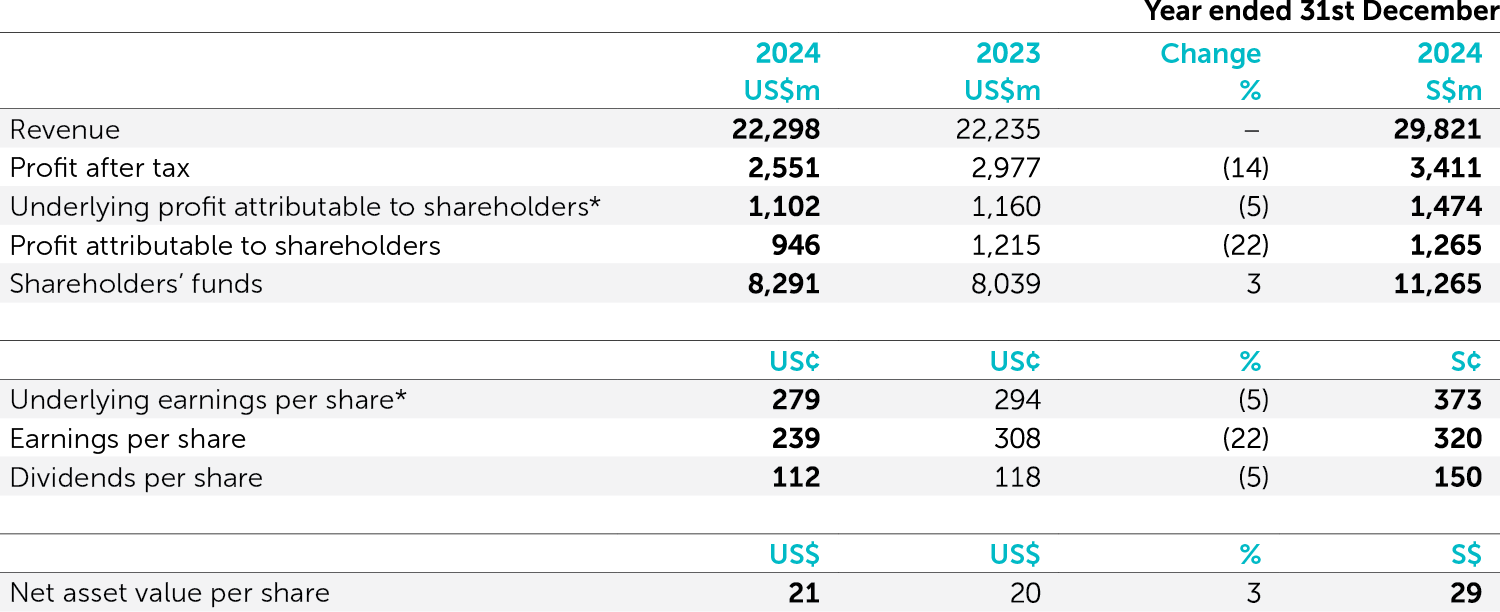

2024 was another encouraging year for JC&C. Results were broadly stable, despite challenging market conditions, and we believe that the business continues to take the right steps to achieve sustainable longterm growth and consistently deliver attractive shareholder returns, by actively evolving our portfolio and allocating capital to high-growth opportunities.

The exchange rate of US$1 = S$1.36 (31st December 2023: US$1 = S$1.32) was used for translating assets and liabilities at the balance sheet date and US$1 = S$1.34 (2023: US$1 = S$1.34) was used for translating the results for the period.

* The Group uses ‘underlying profit attributable to shareholders’ in its internal financial reporting to distinguish between ongoing business performance and non-trading items. Items classified as non-trading items include: fair value gains or losses on revaluation of investment properties, agricultural produce and equity investments, which are measured at fair value through profit and loss; gains and losses arising from the sale of businesses, investments and properties; impairment of non-depreciable intangible assets, associates and joint ventures and other investments; provisions for closure of businesses; acquisition-related costs in business combinations and other credits and charges of a non-recurring nature that require inclusion in order to provide additional insight into the Group’s underlying business performance.

We are pleased that the teams across our markets have navigated through challenges, to deliver consistent earnings and dividend growth for our shareholders.

Our active portfolio management and capital allocation strategy is demonstrated by a robust framework of recycling capital out of our non-core assets or assets that no longer align with our overarching growth strategy.

We are committed to achieving our sustainability goals and creating evermore opportunities for all our stakeholders in the region. Our sustainability framework, underpinned by the principles of good governance and transparency, serves as a comprehensive approach to safeguarding shareholder value, upholding ethical practices and embracing a forward-thinking mindset all while supporting our overall long-term portfolio strategy and capital allocation plans.