Building Sustainability

Read moreAs the world’s fourth most populous country with over 270 million people and a rapidly growing middle class, Indonesia is witnessing the transformation of traditional industries. Digital disruption in financial services has emerged to cater to Indonesia’s young and increasingly urbanised population. On the healthcare front, the uneven distribution of healthcare resources throughout the archipelago has accelerated the expansion of HealthTech to make basic healthcare more accessible.

Driven by its commitment to support the development of the nation and positively impact the lives of the Indonesian people, Astra continues to extend beyond its core businesses and invest in innovative solutions. Digital transformation strategies are accelerated and new technologies adopted.

moXa

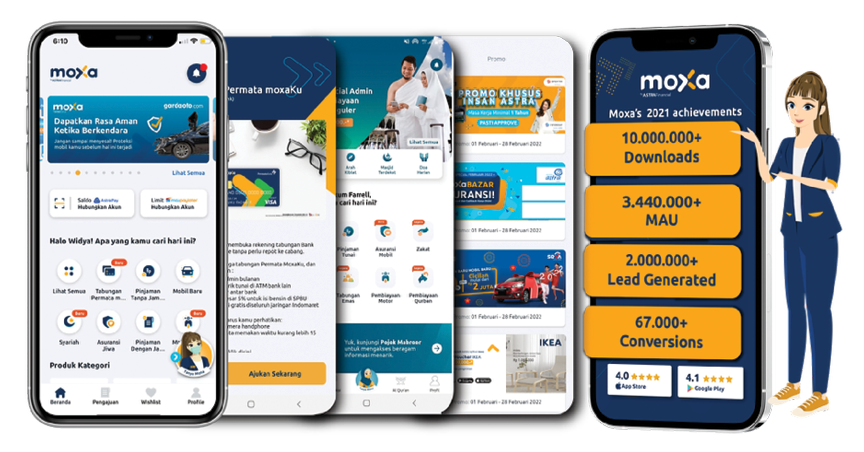

moXa is a mobile app that integrates Astra’s financial services offerings on a single platform to cater to the needs of customers. Within one year of its launch, moXa reached 10 million downloads. By the end of 2021, moXa has over three million monthly active users.

Currently, moXa provides over 25 offerings including financing for new and used cars as well as motorcycles; motor insurance, life and health insurance; microlending, personal and commercial loans; and digital payments. Through moXa, users are also able to open a new savings account with Permata Bank in less than five minutes.

These products will be further supported with gamification, bundling offers, new products and an omnichannel experience going forward. This enables moXa to adopt a customer-centric approach, focusing on customer needs while delivering improvements for different customer segments.

AstraPay

Over half of Indonesia’s population are smartphone users, yet it lags China and India in terms of cashless payments usage propensity. This represents significant growth potential for digital wallets. Astra is a trusted and well-known brand in Indonesia. This provides confidence that its digital wallet, AstraPay, which was launched in September 2021, will achieve strong growth rates in terms of usage and reach.

AstraPay provides a convenient and seamless solution as a mobility wallet for customers to make public transportation and motor vehicle payments while also offering a range of automotive and personal insurance plans. AstraPay aims to broaden its services such as parking and smart wallet that tracks expenses and household budgets. More than a digital solution, AstraPay also serves a strategic role for Astra. It aims to deepen Astra’s existing customer relationships with bespoke offerings and serves as a catalyst to open up new opportunities for broader digital initiatives going forward.

Halodoc

In 2021, Astra invested US$35 million in Halodoc, a leading Indonesian-based HealthTech startup. Halodoc is a digital platform that connects patients to the healthcare ecosystem including doctors, pharmacies, medical laboratories and insurance providers.

Providing technology-based consultations and medical services allow more people across the country to access healthcare. According to the World Health Organization, there were on average only six physicians to every 10,000 people in Indonesia in 2020 as compared to the global average of 19. With over 20,000 general practitioners and specialists, 18 million monthly active users and having the most comprehensive ecosystem, Halodoc is well-positioned to aid the Indonesian community in providing access and delivering healthcare to more people.

Astra’s participation in Halodoc aligns well with its commitment to the nation and its people. Astra’s investment will enable Halodoc to deepen its penetration into key healthcare verticals across Indonesia. The COVID-19 pandemic has magnified the need for greater healthcare access and Halodoc was appointed to support the roll out of the nation’s vaccination programme. Its strong network and proven technology capabilities pave the way for Halodoc to become a leading vaccination facilitator in Indonesia.

Following Astra’s investment into Halodoc, Asuransi Astra, the non-life insurance arm of Astra entered into a partnership with Halodoc to launch Garda HealthTech, a digital-only health insurance plan. This co-creation offers affordable insurance coverage plans accessible through the Halodoc app. This collaboration between an established insurance provider and a leading HealthTech player is well-positioned to provide relevant and innovative digital services to support the evolving needs of consumers. It also empowers Astra to strengthen its existing businesses by building close adjacencies that will allow it to tap new growth drivers across its value chain.